The Rise of Remote Accounting Jobs: Why an Accounting Course is Key in 2025, 100% Job, Accounting Course in Delhi,

10 hours ago Delhi, India Ad Views:31 Ad ID: 611Additional Details

- Ad ID611

- Posted On10 hours ago

- Ad Views31

- Salary period *Monthly

- Position type *Full-time

Description

Remote accounting jobs are experiencing unprecedented growth in 2025, with projections indicating that 60 to 90 million Indians will be working remotely—roughly 10–15% of the workforce. This shift is driven by the desire for flexibility, autonomy, and improved work-life balance, as well as advances in digital tools and cloud-based accounting platforms. For accounting professionals, this means the ability to access lucrative opportunities, both within India and globally, without being tied to a traditional office. Companies of all sizes, from startups to multinational firms, are actively seeking remote accountants, auditors, tax consultants, and financial analysts to support their operations.

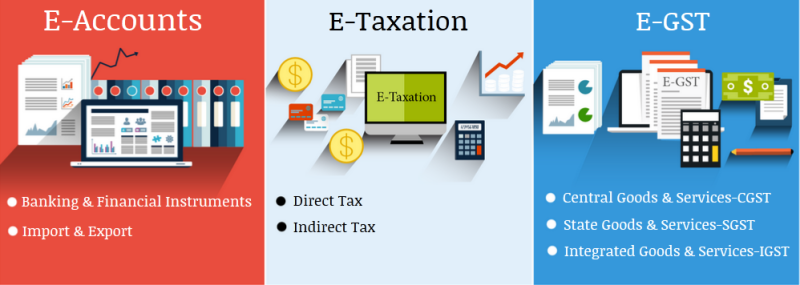

To thrive in this remote-first environment, accountants must possess a blend of technical and soft skills tailored for digital collaboration. Proficiency in cloud accounting software such as SAP, Tally Prime, QuickBooks, and Xero is essential, as is the ability to work with ERP systems for managing complex financial data. Employers also value expertise in GST compliance, ITR preparation, and direct tax codes, given the dynamic regulatory landscape in India. Soft skills like time management, communication, and self-discipline are equally important, enabling remote accountants to manage projects independently and maintain strong client relationships across virtual channels.

A job-oriented Accounting Training in Delhi’s 110011 area, such as the one offered by SLA Consultants India, is specifically designed to prepare candidates for this evolving market. The curriculum includes free SAP FICO certification, GST certification, ITR & DTC classes with 2025 updates, and Tally Prime certification—covering the full spectrum of technical skills required for remote accounting roles. These certifications not only validate your expertise but also demonstrate your readiness to handle the latest accounting technologies and regulatory requirements, making you highly attractive to employers offering remote positions.

Remote accounting jobs offer numerous benefits beyond flexibility, including access to international roles, competitive salaries, and the ability to work with diverse clients and industries. Average salaries for remote accounting roles in India range from ₹3–10 lakh per annum, with specialized positions such as remote tax consultants and staff accountants commanding even higher pay. Leading companies like Deloitte, PwC, Amazon, and various startups are embracing remote hiring, further expanding opportunities for certified professionals.

Enrolling in a comprehensive accounting course with multi-certification options is the key to securing a 100% job guarantee in the remote accounting sector. By mastering SAP FICO, GST, ITR & DTC, and Tally Prime, you position yourself for success in 2025’s remote job market, backed by strong placement support and industry recognition from top employers in India and abroad.

SLA Consultants The Rise of Remote Accounting Jobs: Why an Accounting Course is Key in 2025, 100% Job, Accounting Course in Delhi, 110011 - Free SAP FICO Certification by SLA Consultants India, GST Certification, ITR & DTC Classes with 2025 Update, Tally Prime Certification, details with New Year Offer 2025 are available at the link below:

https://www.slaconsultantsindia.com/accounts-taxation-training-course.aspx

https://slaconsultantsdelhi.in/training-institute-accounting-course/

Certified Taxation, Accounting, Finance CTAF Course

Module 1 – Advanced Goods & Services Tax Practitioner Course - By CA– (Indirect Tax)

Module 2 - Part A – Advanced Income Tax Practitioner Certification

Module 2 - Part B - Advanced TDS Practical Course

Module 3 - Part A - Finalization of Balance sheet/Preparation of Financial Statement & Banking-by CA

Module 3 - Part B - Banking & Finance

Module 4 - Customs / Import & Export Procedures - By Chartered Accountant

Module 5 - Part A - Advanced Tally Prime & ERP 9

Module 5 - Part B - Tally Prime & ERP 9 With GST Compliance

Module 7 – Advanced SAP FICO Certification

Contact Us:

SLA Consultants India

82-83, 3rd Floor, Vijay Block,

Above Titan Eye Shop,

Metro Pillar No. 52,

Laxmi Nagar, New Delhi,110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/